Canned Tuna Market Size Expected to Reach USD 45.17 Bn by 2034 Amid Rising Demand for Protein-Rich, Health-Conscious Foods

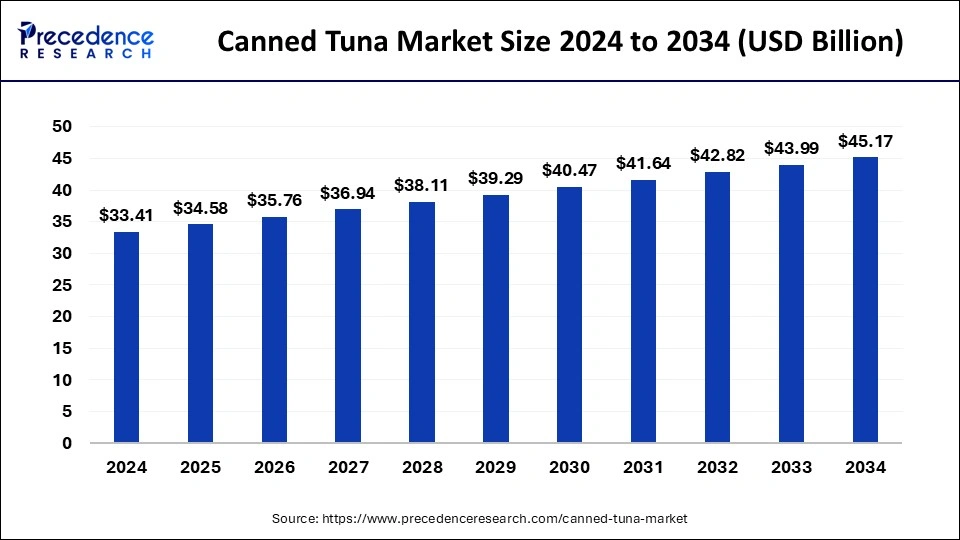

According to Precedence Research, the global canned tuna market size has been calculated at USD 34.58 billion in 2025 and is expected to reach approximately USD 45.17 billion by 2034, with a CAGR of 3% from 2025 to 2034. The growing consumer demand for protein-rich foods and increasing awareness about tuna's health benefits drive the market growth.

Ottawa, July 22, 2025 (GLOBE NEWSWIRE) -- In terms of revenue, the worldwide canned tuna market surpassed USD 33.41 billion in 2024 and is projected to rise from USD 34.58 billion in 2025 to 42.82 billion by 2032. With the surge in health-conscious eating, a rise in sustainable seafood sourcing, and the booming convenience food sector, the global canned tuna market is swimming into a new era of innovation and consumer engagement.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/1248

What is Canned Tuna?

Canned tuna is a processed tuna fish sealed in a can. The heat sterilization process involves canning to avoid the spoilage of fish. Canned tuna is available in two types: light and white. The light canned tuna is softer & darker flesh made from a combination of smaller tuna species, skipjack, and yellowfin. The white canned tuna is a mild-flavored, light-colored, firm-textured tuna, which is also known as albacore tuna.

Canned Tuna Market Quick Insights:

- The canned tuna market size reached USD 33.41 billion in 2024.

- It is projected to surpass USD 45.17 billion by 2034.

- The market is growing at a CAGR of 3% (2025-2034).

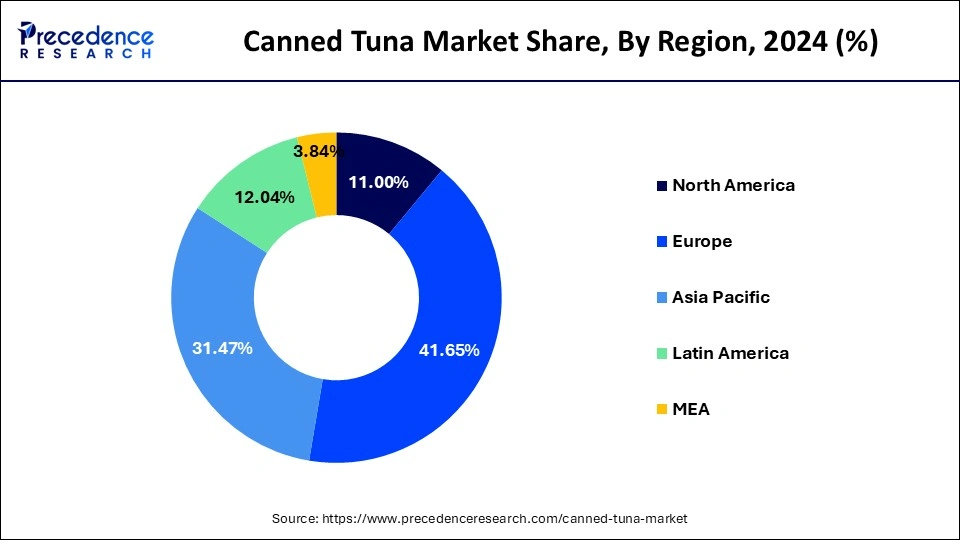

- Europe accounted for the largest market share of 41.65% in 2024.

- Middle East & Africa is expected to grow at the fastest CAGR from 2025 to 2034.

- The U.S. canned tuna market size has been calculated at USD 3.19 billion in 2025.

- By type, the ready-to-cook segment is expanding at a significant CAGR between 2025 and 2034.

- By tuna species, the skip jack segment held the major market share of 61.65% in 2024.

Top Exporters of Canned Tuna in the World

| Country Name | Export in Shipments |

| Vietnam | 12544 |

| Ecuador | 8695 |

| United States | 8233 |

Canned tuna is packed in different mediums like water, oil, and brine. It is an excellent source of vitamin D, B12, protein, and omega-3 fatty acids. Canned tuna helps in weight loss by reducing cravings. It has a stable shelf life and is very convenient for quick meals.

Canned Tuna Market Overview:

The global canned tuna market has witnessed steady growth over the past decade, driven by rising demand for convenient, protein-rich, and shelf-stable food products. Canned tuna offers high nutritional value with minimal preparation, making it a popular choice for busy consumers. Tuna is rich in omega-3 fatty acids, lean protein, and vitamins, appealing to health-conscious buyers. Manufacturers are diversifying product offerings with flavored varieties, low-sodium options, and organic tuna, as well as eco-friendly packaging to attract wider demographics.

Read Full Market Overview@ https://www.precedenceresearch.com/canned-tuna-market

Shifting Consumer Preferences

Modern consumers are favoring single-serve, low-sodium, and flavored options aligned with healthy snacking habits. Millennials and Gen Z are driving demand for ethically sourced seafood, while older demographics prioritize value and protein intake. Keto-friendly labeling and high-protein diets have boosted tuna’s positioning in fitness and wellness categories.

What are the Different Types of Tuna?

| Tuna | Description |

| Skipjack Tuna |

|

| Albacore Tuna |

|

| Yellowfin Tuna |

|

| Bigeye Tuna |

|

| Bluefin Tuna |

|

Canned Tuna Market Opportunity

What is the Opportunity for the Canned Tuna Market?

The Growing Expansion of E-commerce

The growing expansion of e-commerce platforms in various regions unlocks an opportunity for the market. The growing consumer preference for online grocery shopping and increasing food delivery services fuels the adoption of canned tuna. The busy schedules of individuals give preference to online ordering of canned tuna for its nutritional benefits. The targeted advertising and promotions on the e-commerce platforms and the availability of subscription-based services increase demand for canned tuna products.

The availability of sustainably sourced varieties, flavored tuna, and premium options helps the market growth. The growing remote areas demand for canned tuna increases sales of e-commerce. The availability of various brands of canned tuna online and easy browsing increases the purchase of canned tuna. The direct-to-consumer approach of e-commerce increases sales of canned tuna on e-commerce platforms. The growing expansion of e-commerce creates an opportunity for the growth of the canned tuna market.

Future Trends to Watch in the Canned Tuna Market

The market is likely to witness tech-driven innovation including blockchain-powered traceability, AI-based demand forecasting, and customized flavor packs based on regional palates. Plant-based tuna alternatives and functional canned tuna with added nutrients (e.g., calcium, collagen) may carve niche demand.

Canned Tuna Market Challenges:

What are the Challenges of the Canned Tuna Market?

-

Raw Materials Cost Volatility:- With the several benefits of canned tuna, the fluctuating cost of raw materials restricts the market growth. Factors like weather conditions, economic conditions, supply & demand, and fishing regulations are responsible for raw materials cost volatility. The economic conditions, like currency fluctuations, inflation, and many more increase the raw materials costs. Factors like changing fishing quotas, overfishing, and climate change are responsible for fluctuating costs. The raw materials cost volatility hampers the growth of the canned tuna market.

- Growth in Plant-Based Alternatives:- Despite several advantages of canned tuna, rapid growth in plant-based alternatives limits the expansion of the market. The growing shift towards vegetarianism and veganism increases the focus on the development of plant-based tuna. The growing consumer demand for cruelty-free food products fuels demand for plant-based products. The growth in plant-based alternatives hampers the canned tuna market's growth.

Sustainability and ESG Trends in Canned Tuna

Sustainability is shaping consumer preferences and regulatory landscapes. MSC-certified tuna, dolphin-safe practices, and reduced bycatch methods are gaining traction. ESG metrics such as traceability, community-based fisheries, and low-carbon packaging are increasingly critical in procurement decisions across the value chain.

Canned Tuna Market Report Coverage:

| Report Attributes | Key Statistics | |

| Market Size in 2024 | USD 33.41 Billion | |

| Market Size in 2025 | USD 34.58 Billion | |

| Market Size in 2030 | USD 40.47 Billion | |

| Market Size in 2032 | USD 42.82 Billion | |

| Market Size by 2034 | USD 45.17 Billion | |

| CAGR (2025-2034) | 3% | |

| Base Year | 2024 | |

| Forecast Years | 2025 to 2034 | |

| Historic Years | 2020 to 2023 | |

| Key Growth Drivers | Rising demand for ready-to-eat seafood, health-conscious diets, global shelf-stable food trends | |

| Challenges | Sustainability concerns, fluctuating raw material prices, regulatory limits | |

| Competitive Landscape | Highly fragmented with key players focusing on eco-labels and supply chain efficiency | |

| Segments Covered | Tuna Species, Type, and Regions | |

| Tuna Species | Skip jack, Yellowfin, Albacore, Others | |

| Type | Ready-To-Eat, Ready-To-Cook | |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) | |

Set up a meeting at your convenience to get more insights instantly! https://www.precedenceresearch.com/schedule-meeting

Canned Tuna Market Regional Analysis:

How Big is the Europe Canned Tuna Market Size?

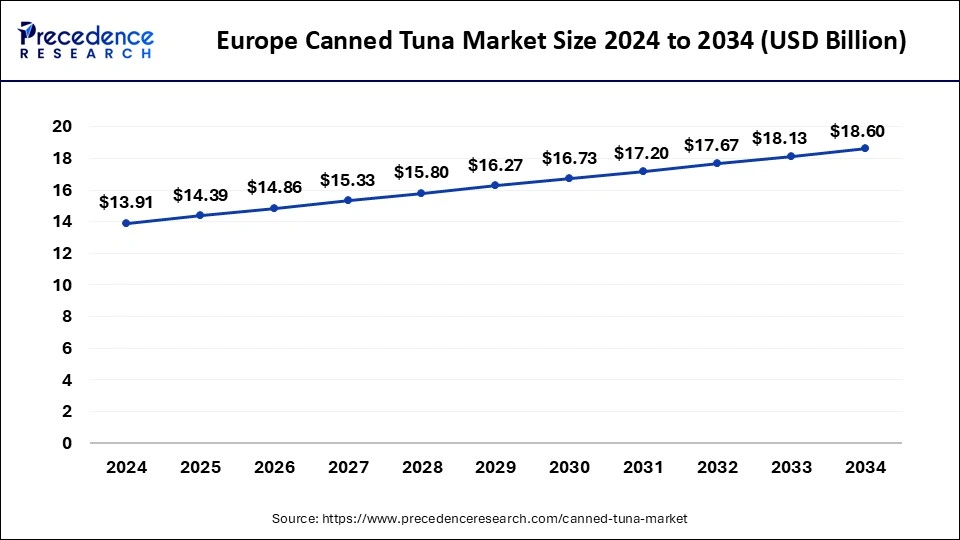

According to Precedence Research, the Europe canned tuna market size is expected to hit USD 18.60 billion by 2034, increasing from USD 14.39 billion in 2025. The market is growing at a CAGR of 2.90% from 2025 to 2034.

The Complete Study is Immediately Accessible | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1248

How Europe Dominated the Canned Tuna Market?

Europe dominated the canned tuna market in 2024. The high consumption of seafood in the region increases demand for canned tuna. The strong presence of the tuna processing industry in countries like Italy and Spain helps the market growth. The consumers' focus on ethically and sustainably sourced products fuels demand for canned tuna.

The growing demand for ready-to-eat meals and the presence of advanced processing facilities increase the demand for canned tuna. The presence of key players like Conservas Ortiz and Group Albacora drives the overall growth of the market.

What Factors Make European Countries Largest Contributors for Canned Tuna?

- High Per Capita Consumption: Southern European countries like Spain, Italy, and Portugal have some of the highest canned tuna consumption rates in the world, driven by traditional Mediterranean diets.

- Rising Demand for Healthy & Convenient Foods: European consumers are increasingly opting for protein-rich, low-fat foods, making canned tuna a staple in health-conscious meal planning.

- Sustainability-Driven Purchases: EU consumers prioritize sustainably sourced tuna (e.g., MSC-certified, dolphin-safe), prompting brands to reformulate offerings and enhance traceability.

- Private Label Growth: Supermarket chains across Europe are expanding private label tuna products, making canned tuna more affordable and boosting volume sales.

- Innovative Product Launches: Companies are introducing value-added products such as flavored tuna, ready-to-eat meals, and snack-size portions tailored to modern lifestyles.

- Trade & Import Support: Europe remains a major importer of canned tuna, especially from countries like Ecuador, the Philippines, and Thailand, benefiting from favorable EU trade agreements.

Why is Asia Pacific a Critical Player in the Global Canned Tuna Market?

Asia Pacific is expected to witness consistent growth owing to rising urbanization, increasing working-class population, and a long-standing cultural preference for seafood. Countries like Thailand and the Philippines are not only major exporters but also seeing growth in domestic consumption. India’s canned food sector, supported by rising modern trade and food delivery platforms, adds further momentum.

Why is North America the Fastest-Growing in the Canned Tuna Market?

North America is significantly growing in the canned tuna market. The growing consumer preference for protein-rich foods increases demand for canned tuna. The increasing demand for ready-to-eat meals helps the market growth. The increasing health consciousness among consumers fuels demand for canned tuna. The increasing expansion of e-commerce platforms and the retail availability of canned tuna support the overall growth of the market.

How Big is the U.S. Canned Tuna Market Size?

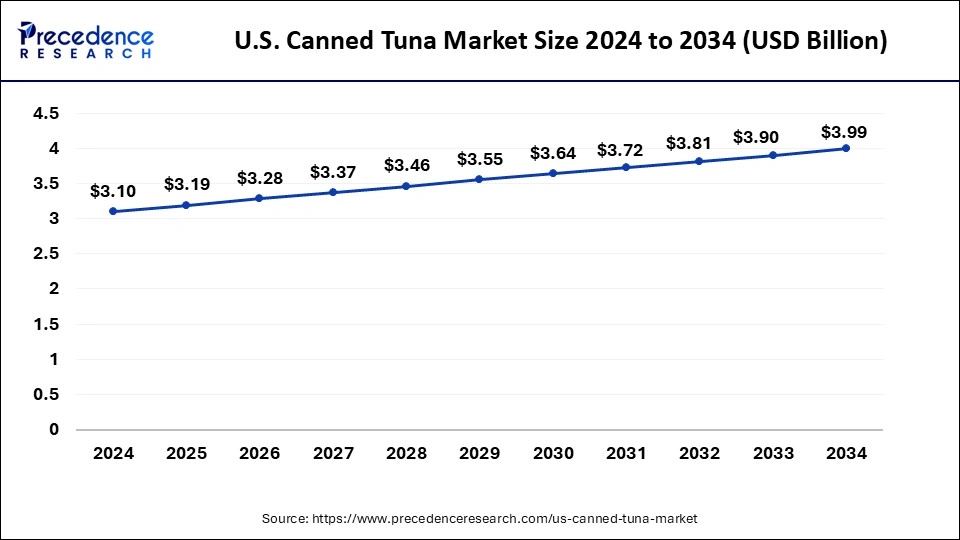

The U.S. canned tuna market size is valued at USD 3.19 billion in 2025 and is estimated to touch over USD 3.99 billion by 2034 with a CAGR of 2.50% from 2025 to 2034.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report of U.S. Canned Tuna Market @ https://www.precedenceresearch.com/sample/3765

U.S. Canned Tuna Market Highlights:

- The flavored segment dominated the market in 2024.

- The B2C segment held the major market share in 2024.

- The direct sales segment contributed the highest market share in 2024.

- The skip jack segment accounted for the largest market in 2024.

The U.S. canned tuna market is a significant segment within the country's broader seafood industry, valued for its convenience, affordability, and nutritional profile. As of 2025, the market continues to gain traction, supported by shifting consumer preferences toward protein-rich, ready-to-eat foods. With growing awareness of heart health, weight management, and lean protein consumption, canned tuna has become a staple in American households, foodservice outlets, and institutional kitchens. The demand is further boosted by the expanding working-class population seeking convenient meal options that align with their busy lifestyles.

The market is primarily segmented by species type, with Skipjack and Yellowfin tuna dominating shelves due to their favorable taste and cost-effectiveness. In terms of product type, canned tuna in oil remains popular for its richer flavor, while tuna in water appeals to health-conscious consumers monitoring their fat intake. Canned tuna in brine also holds a considerable share among traditional consumers. Additionally, the market sees growth in BPA-free packaging, easy-open lids, and sustainable tuna sourcing as consumers become more environmentally and ethically conscious.

From a distribution channel perspective, supermarkets and hypermarkets remain the leading sales avenues, though online grocery platforms are quickly rising, driven by the digital shopping boom and subscription-based seafood delivery services. Retailers are responding to this trend by enhancing product visibility, bundling offers, and offering private-label alternatives to meet demand across income groups.

Regionally, while demand is widespread across the U.S., coastal states like California, Florida, and New York lead the market, influenced by cultural seafood preferences and higher health awareness. The presence of major industry players such as Bumble Bee Foods, StarKist Co., and Chicken of the Sea ensures consistent product availability, competitive pricing, and ongoing innovation in product offerings.

However, the market faces challenges, particularly around sustainability, overfishing concerns, and rising raw material prices. Regulatory scrutiny related to mercury content and eco-labeling is pushing manufacturers to adopt traceability and sustainable fishing practices. Looking ahead, the U.S. canned tuna market is expected to remain stable, with modest growth driven by evolving consumer habits, product diversification, and stronger commitments to ethical sourcing.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3765

Global Canned Tuna Market Segmentations Analysis:

Tuna Species Analysis:

How Did Skipjack Segment Dominated the Canned Tuna Market?

The skipjack segment dominated the canned tuna market in 2024 due to the increasing consumer preference for health benefits and mild flavor. The increasing demand across culinary applications like salads, pasta, sandwiches, and casseroles fuels demand for skipjack, helping in the market growth.

Skipjack is found in subtropical and tropical waters in large quantities. It is budget budget-friendly product and consists of a slightly meaty flavor. The increasing focus on sustainable fishing and growing regular consumption drives the overall market growth.

Also Read@ Quick Bites, Big Business: Inside the Global Fast Casual Restaurant Boom

Why Yellowfin Tuna Demand is Growing?

The yellowfin segment is the fastest-growing in the market during the forecast period, owing to the increasing demand for dishes like gourmet meals and sushi that fuels demand for yellowfin tuna. The rising consumer focus on sustainably sourced seafood helps the market growth.

Yellowfin tuna is an excellent source of omega-3 fatty acids & lean protein and consists of a firm texture. It is slightly sweet in flavor and has a meaty texture. The growing availability of yellowfin tuna in supermarkets and hypermarkets supports the overall growth of the market.

Also Read@ Milk Protein Market Set to Soar with Rising Health Consciousness and Nutritional Innovation

Type Analysis:

How did Ready-to-Eat Segment Lead the Canned Tuna Market?

The ready-to-eat segment dominated the canned tuna market in 2024 owing to the rising availability across easy-to-access supermarkets and hypermarkets. The limited time for meal preparations and cooking increases demand for ready-to-eat canned tuna.

The busy lifestyles and the growing number of dual-income households help the market growth. The increasing demand for on-the-go consumption, quick meals, and snacks fuels demand for ready-to-eat canned tuna. The growing number of single-person households and the versatility of canned tuna drive the overall growth of the market.

Also Read@ Ready-to-Eat Revolution: Exploring the Processed Snacks Market

Why Ready-to-Cook is the Fastest Growing in the Canned Tuna Market?

The ready-to-cook segment is growing significantly in the market owing to the increasing demand for easy and quick meal options fuels demand for ready-to-cook canned tuna. The growing consumer awareness about eating healthy and nutritious food increases demand for ready-to-cook canned tuna.

The increasing consumer focus on eliminating marinating, cooking, and defrosting increases demand for ready-to-cook canned tuna. The expansion of e-commerce platforms fuels the adoption of ready-to-cook canned tuna. The growing working individuals and busy schedules support the overall growth of the market.

Related Topics You May Find Useful:

-

Tuna Peptides Market 2025 to 2034: The global tuna peptides market size was accounted for USD 1.02 billion in 2024 and is expected to exceed around USD 1.64 billion by 2034, growing at a CAGR of 4.86% from 2025 to 2034.

-

Canned Alcoholic Beverages Market 2025 to 2034: The global canned alcoholic beverages market size was estimated at USD 25.20 billion in 2024 and is predicted to increase from USD 30.32 billion in 2025 to approximately USD 76.40 billion by 2034, expanding at a CAGR of 11.73% from 2025 to 2034.

-

Fish Pumps Market 2025 to 2034: The global fish pumps market size was calculated at USD 136.16 million in 2024 and is predicted to increase from USD 145.88 million in 2025 to approximately USD 271.37 million by 2034, expanding at a CAGR of 7.14% from 2025 to 2034.

-

Canned Alcoholic Beverages Market 2025 to 2034: The global canned alcoholic beverages market size was estimated at USD 25.20 billion in 2024 and is predicted to increase from USD 30.32 billion in 2025 to approximately USD 76.40 billion by 2034, expanding at a CAGR of 11.73% from 2025 to 2034.

-

Fish Processing Market: The global fish processing market size was worth around USD 390.37 billion in 2024 and is anticipated to reach around USD 693.83 billion by 2034, growing at a solid CAGR of 5.92% over the forecast period 2025 to 2034.

-

Canned Fruits Market 2025 to 2034: The global canned fruits market size is calculated at USD 12.37 billion in 2024 and is anticipated to reach around USD 17.56 billion by 2034, expanding at a CAGR of 3.57% between 2024 and 2034.

-

Fish Protein Hydrolysate Market 2025 to 2034: The global fish protein hydrolysate market size accounted at USD 328.94 million in 2024, and is expected to reach around USD 473.04 million by 2034, expanding at a CAGR of 3.70% from 2025 to 2034.

- Canned Mushroom Market 2025 to 2034: The global canned mushroom market size is accounted for USD 9.64 billion in 2024 and is projected to reach around USD 16.96 billion by 2034, growing at a CAGR of 5.81% from 2024 to 2034.

Canned Tuna Market Top Companies

- Thai Union Group PCL

- Frinsa del Noroeste SA

- Jealsa Rianxeira SA

- Century Pacific Food, Inc.

- Golden Prize Canning Co. Ltd.

- Albacora S.A.

- American Tuna, Inc.

- Wild Planet Foods, Inc.

- Ocean Brands GP (The Jim Pattison Group)

- C.F. Fishery Co., Ltd (Bumble Bee Foods, LLC)

“Leading players are intensifying efforts around sustainable fishing, recyclable packaging, and product diversification. Thai Union, for instance, has ramped up its eco-label certifications, while Wild Planet is targeting clean-label snack innovation. Strategic collaborations and direct-to-consumer initiatives are becoming central to market positioning.”

Canned Tuna Market Recent Developments:

- In December 2024, Oman’s Simak launched its first canned tuna consumer products. The new facility can produce annually 100 million cans and offers high-quality canned fish products. The products are available in supermarkets in Oman. (Source: https://www.undercurrentnews.com)

- In January 2023, Vgarden Ltd launched vegan canned tuna made from sunflower oil and pea protein. The product is scalable, sustainable, clean-label, and affordable. The product is available in food service sectors and retail stores. (Source: https://www.foodmanufacturing.com)

- In August 2024, Wild Planet Collaborated with Simple Mills & Chosen Foods to launch a limited edition of wild tuna snack packs. The packs are available on the Wild Planet official website for $5. (Source: https://www.businesswire.com)

Canned Tuna Market Segments Covered in the Report

By Tuna Species

- Skip Jack

- Yellowfin

- Others

By Type

- Ready-To-Eat

- Ready-To-Cook

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1248

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.